With marketing expenses and the cost of the onboarding process, acquiring new customers is costly. As a result, while it is important to grow your customer base, an equally valuable (and more cost effective) business strategy is to grow the lifetime value of your existing customers. Therefore, brands should implement a set of three strategic safety nets around their customers to prevent customer churn and increase customer lifetime value:

- Customer experience management to improve customer satisfaction and reduce churn

- Total relationship loyalty programs and personalization to keep customers engaged and coming back

- Churn prediction data analysis to identify high value customers and churn risks before it's too late

How the three safety nets apply across the entire customer lifecycle to reduce churn

Once customers are acquired, brands must use customer experience management (CEM) to keep customers satisfied. Proactively managing the customer experience is a key delivery vehicle of a company's brand promises and, therefore, allows a company to either make or break its promises to customers. Research shows that companies with a branded customer experience management approach achieve higher customer satisfaction and retention rates. However, no organization can offer a flawless experience to all customers all of the time and some customers will slip through that first safety net.

In cases where a customer has a less than ideal experience, they will fall through the first safety net. But if a compelling Total Relationship Loyalty (TRL) program is in place, it can help keep the customers feeling satisfied. Research shows that customers experiencing a loyalty program relevant to their lifestyles are less likely to switch to a competitor, even if only to keep earning relevant rewards. However, even the best loyalty programs do not engage all customers. In many industries, the average for a loyalty program is to have more than 60 percent of the customers enrolled, with about 50 to 70 percent redemption rates. In other words, there is still a large percentage of customers who aren't swayed by a brands loyalty program, and customer attrition will still occur.

It is exactly when the first two safety nets fail, that the third safety net can mean the difference between keeping and losing a customer. It is critical that a company have an insights infrastructure in place to be able to accurately predict the risk of churn and work proactively on retaining high-value customers. For example, churn prediction and prevention measures allow a brand to develop models that assign a churn probability score to each customer, generally with an eight- to 10-week prediction window. The brand would then develop a library of churn prevention campaigns with automated rules based on customer behavior, customer value, and churn risk.

With a general understanding of our three churn best practices, and how they work in tandem throughout the customer lifecycle, lets look at each safety net in detail, so that you can understand how to implement and optimize it for your business.

Churn Safety Net #1: Customer Experience Management

Companies are increasingly realizing the importance of managing the customer experience throughout the customer journey, with the goal of turning satisfied customers into loyal advocates. Companies must proactively create the desired customer experiences and effectively manage them to successfully create long-term trusted relationships.

Our Customer Experience Framework outlines how customer experience leads to Return on Customer (ROC equals a firm's current-period cash flow from its customers plus any changes in the underlying customer equity, divided by the total customer equity at the beginning of the period). The framework shows how customer brand perception is transformed to brand realization with customer experience. CEM is vital for brands because it builds customer trust while promoting the brand promise.

The main steps for establishing and implementing ideal customer experience management are as follows:

- Assess the current customer experience: Map the customer experience across the customer lifecycle and all touchpoints. Identify the moments of truth. Identify customer preferences and needs.

- Design the customer experience strategy: Establish the vision and guiding principles for CEM. Design future state customer experience for all interactions and touchpoints.

- Implement the CEM strategy: Identify the gaps between current and future state. Define and prioritize the initiatives to close the gaps. Implement and monitor these initiatives.

There are six enablers that need to be at the desired levels to successfully implement a customer experience management program for churn prevention: strategy, organization, processes, customer data, reporting, and tools.

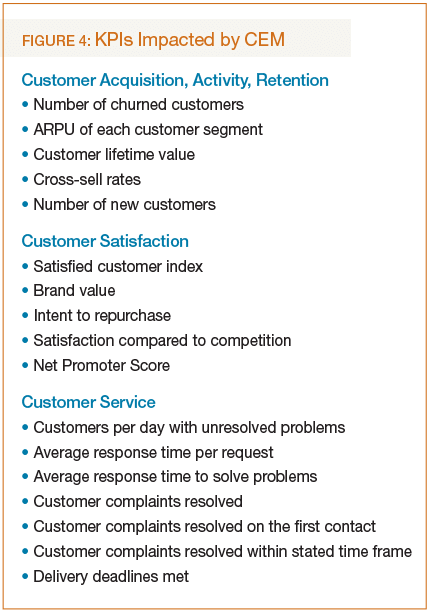

After implementation, one of the most important benefit will be from reducing customer churn, but the level of correlation between CEM and churn varies from segment to segment. Establishing a business case and KPI targets in the beginning of the program is critical to having standards to measure against along the way.

Churn Safety Net #2: Total Relationship Loyalty

Total Relationship Loyalty (TRL) is used to differentiate the customer experience based on customer tiers. It represents a platform to communicate to customers about their differentiated privileges, while CEM represents the basis and lays down the fundamentals of the different treatments.

TRL goes well beyond mere points-based loyalty programs. While basic points programs reward customers for their use of services through earning and redeeming points, TRL helps brands manage and nurture all types of customer interactions.

The objectives are two-fold: first, to increase customer insight, learn more about customers, and consequently, serve them better with customized rewards; and second, to develop and strengthen customer relationships, further engage them, and engage them recurrently. The increased personalization will help strengthen overall customer loyalty, helping to prevent customer churn.

Total relationship loyalty is composed of three pillars:

- Customers: Different customers should belong to different program tiers. Customers can be tiered based on their value to the company and also based on their lifestyle. Tiering is essential to be able to treat different customers differently and provide customized rewards and treatment for them.

- Products and services: Products and services are the core program rewards; they can also be the main drivers for customers to earn points. TRL can guide different marketing strategies, e.g. by offering upsell as rewards.

- Channels: Channels represent other forms of rewards and allow the expansion of loyalty engagement across all customer interactions. TRL can contribute to a successful channel strategy by designing earn-and-rewards rules to drive desired customer behavior related to channel usage.

There are four key success factors required to ensure the effective fulfillment of TRL. First, TRL should be an integral part of a brand's customer strategies. Although a TRL program should have its own defined strategy, objectives, and KPIs, it's essential to ensure alignment with other customer initiatives whenever and wherever it is needed.

Second, TRL should be endorsed by the whole organization and managed by a dedicated and centralized team, as well as championed by a proactive person within that team. The team should include members with growth analytics competencies who can collect and process customer insight and profiling, and assess program performance by processing and analyzing KPIs.

Additionally, a TRL program's business case and ROI model should be developed and tracked over time to accommodate its budget, evaluate program performance, and add required improvements and refinements. A TRL program also should be well positioned and communicated to customers. The right communication is a critical lever that is capable of turning TRL into a key differentiator over the competition.

Finally, a TRL program with different components should be designed, operationalized, and aligned with personalized customer needs and other customer-centric strategic initiatives. The program should be simple with a rich customer experience for program interactions. A successful and effective TRL program should bring a positive impact on the company's business. This impact is measured through a number of indicators, including positive ROI, improved Return on Customer, and increases in customer acquisition, retention, and referrals.

Churn Safety Net #3: Preventing Churn with predictive analytics

Lowering customer churn rates is universally challenging for brands, but retaining highly profitable customers can prove to be even more arduous.

That's due to the fact that predicting churn and then designing cost-effective strategies to reduce it are extremely difficult undertakings for most companies. Such projects require organizing and analyzing huge volumes of data that are often difficult to access and consolidate. Many organizations simply lack the ability to support the complex data mining and analytical tasks that are essential to combating churn.

Churn affects the profitability of a company most when a customer churns before the company can earn back the investment it incurred when acquiring the customer. Therefore, it is critical to identify profitable customers and retain them, especially in today's highly competitive market. But what is churn? Customer churn describes the rate at which a company loses its customers. In general, there are two different types of customer churn:

- Voluntary: This occurs when the customer initiates termination of the service contract. Most brands find that the major stated reasons that churn occurs is a result of price, quality, customer service, or image.

- Involuntary: This occurs when people are churned for fraud, non-payment, and under-utilization. The best way to manage this type of churn is to determine who is likely to be fraudulent or create credit problems and prevent them from subscribing in the first place.

After calculating customer churn, companies must develop a mechanism or strategy to predict and prevent it from happening in the future. This should begin with using analytical models to understand customers' likelihood to churn. Using historical analysis of customer behavior, brands can create reliable predictions of future behavior.

- Reach out to customers with automated, event driven marketing campaigns at different alert levels based on usage patterns.

- Identify customer who are low-value price shoppers and stop wasting loyalty marketing budgets on them. Not all customer churn is bad, let some low value customers go.

- Use social media to track and respond to customer feedback.

- Align offers with a customer's lifecycle (e.g., avoid early life dormancy, make a welcome call, explain bills or fees, and increase engagement via free service offers.

- Put channels into fighting shape and systematically own and escalate churn at the first point of touch.

- Educate channels about offer abuse (e.g., giving excessive, expensive save offers to customers bluffing about their churn intent).

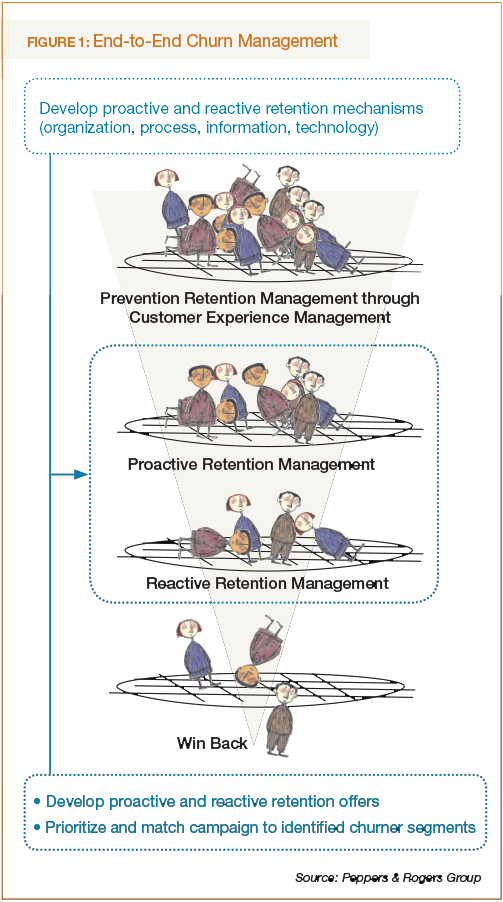

In order to effectively fight churn, companies need to focus on the critical success factors of churn prevention. These include culture, process, and data issues. In addition, companies must implement an end-to-end retention program, which entails not only churn analysis, but also strategy and action development, deployment, and continuous monitoring.

Customer churn prevention strategies are the key to brand success

In this article, we've provided details about three key strategic safety nets to implement in order to prevent customer churn. A customer experience management strategy can improve customer satisfaction and reduce churn, a total relationship loyalty program and personalization approach can help keep customers returning to your brand, and churn prediction data analysis can provide actionable insights to help identify customers who are at risk as well as high value customers worth trying to retain.

These three safety nets can also be viewed from the perspective of the three main phases of churn prevention: operations and process, avoidance and deflection, and proactive identification.

1. Operations and Process:

- Design end-to-end retention processes

- Design a retention-focused organization structure with a save team, establish joint management accountability, and align the employee culture

- Define the technology requirements to facilitate implementation

- Define information requirements to ensure ideal data availability for increased effectiveness

2. Avoidance and Deflection:

- Customize proactive offers for usage behavior/patters; prioritize for value and risk propensity

- Customize reactive offers based on specific churn reasons, emphasizing the company's strengths and adjusting customers' price perception.

- Try to persuade customers without giving offers

- Predict possible competitive moves and develop alternative counter-tactics; one company's acquisition strategy is another's churn problem

3. Proactive Identification

- Define the problems, reasons, and root causes of churn

- Develop hypotheses

- Prepare data sets and test the hypotheses to validate their correlation with churn

- Develop alternative predictive churn models

- Evaluate models based on prediction accuracy, robustness, and comprehensibility

- Deploy selected models to score the customer base and dept "value at risk"

- Flag customers with high churn scores in your database

The cost of retaining existing customers is less than the acquisition costs to gain new ones. With a strong customer churn prevention strategy in place, brands can ensure they keep their high-value customers, improve their loyalty, and build their value. See how TTEC keep's customers happy and hits key business goals by investing in existing customer relationships by exploring our Customer Retention and Loyalty Solutions or our sales outsourcing services, or learn more about our CX Strategy and Digital Consulting services.