It's a simple question, with a telling answer: When seeking advice about your healthcare, who has your best interests at heart?

Peppers & Rogers Group queried more than 250 executives, most of whom reside in the United States, about their views on health insurers in its recent study "Health Check: Health Insurance Providers and Customer Centricity." Of those surveyed, 94 percent have health insurance—but few are pleased with their providers. In fact, when asked who has their best interests at heart when seeking advice about healthcare, not one respondent cited their health insurer as having their best interests at heart. In fact, only 23 percent of respondents believe that their health insurance provider consistently acts in their best interests. Doctors are number one, with nearly half of respondents citing them as who has their best interests at heart. Family is a close second, with almost 40 percent citing them. Of the 7 percent who cited "other," the number one response was "self."

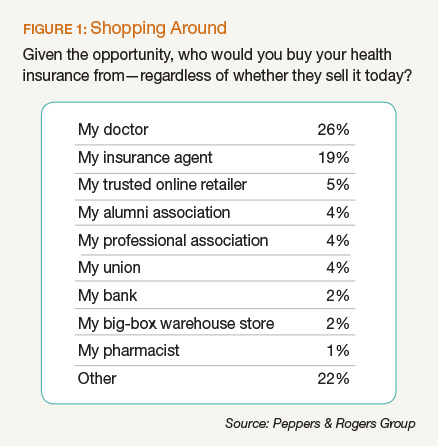

Not surprisingly, respondents would happily buy health insurance from other sources given the opportunity to do so (see Figure 1). About a quarter would purchase health insurance from their doctor, nearly 20 percent would buy it from an associate who currently sells them other types of insurance, and 14 percent would purchase health insurance from a professional association. Of the 22 percent who cited "other," the most common response was "the federal government," followed by "my employer." Other write-in comments cited by multiple respondents included going direct to the insurers, buying from a trusted online resource that would allow for price and benefit comparisons, and purchasing from nonprofit associations.