Linking budgeting with customer strategies is a must in this era of empowered customers. Doing so provides decision-makers not only with a more holistic view of a company's operations, but also with a better understanding of how the behaviors and needs of segmented customer groups will shape future revenues and profits.

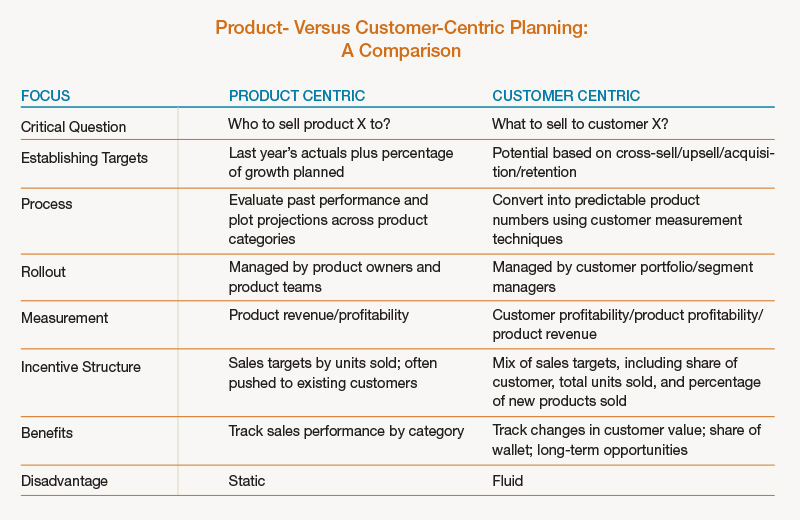

Typically, when financial services executives develop budgets for the coming year, they make decisions from a product-centric standpoint. And although budget planning isn't completely parallel with formulating customer strategy, financial services organizations can benefit greatly by bringing the two into better alignment.

As companies set their revenue targets and other financial goals, executives can chart their strategies in a couple of different ways. By applying a short-term, product-centric approach, they might succeed in meeting their quarterly earnings targets. But in doing so, senior management runs the risk of alienating loyal customers by applying aggressive sales tactics in the drive to meet its near-term financial goals.

By comparison, a customer-centric method of strategy setting is a more balanced approach to engendering long-term customer value while driving greater loyalty and consistent revenue growth. In addition, a customer-centric approach to budget planning helps banks, insurance companies, and other financial services firms cultivate gains in customer lifetime value and customer profitability over the long haul.

As banks and other financial institutions face mounting opportunities for using customer data and analytics in the backdrop of a sluggish economy, executives should be thinking about growing their businesses through customer centricity.

Connecting budgeting with customer strategies

A growing number of companies are attempting to implement customer-centric strategies, but rarely are these efforts linked in any way to the budgeting process. They should be.

Historically, the budgeting process within most financial services companies is focused on resource allocation, while budget planning itself is typically based on budgets and expenditures from the prior fiscal year along with projected revenues, market share figures, and the anticipated costs of delivering products and services for the coming year. For example, a super-regional bank might set a plan to sell 1.2 million mortgages in 2011 based on having sold approximately 1 million mortgages in 2010.

Budget planning in this way is rooted in product-centric financial targets (profits, revenues, cost), while customerfocused strategies are usually conceptualized and executed on a parallel plane. Forward-thinking companies have succeeded in blending the two approaches in order to provide decision-makers with a more holistic view of the company's operations. This includes examining how the anticipated behaviors and needs of segmented customer groups such as private banking clients or young newlyweds can be expected to shape future profits and revenues.

A customer-centric, bottom-up approach to budgeting also provides decision-makers with more realistic financial targets. Instead of plotting budget forecasts solely against prior-year product sales, a customer-focused approach takes into account the behaviors and anticipated needs of segmented customer groups, which ultimately provide executives with greater insights into product demand.

When shaping sales projections for consumer loans, CDs, and other financial products, decision-makers should be considering who they will be selling specific products to instead of solely focusing on the number of products they expect to sell to X number of consumers over a 12-month period. The critical question should not be "who to sell product X to" but "what to sell to customer X."

The good news for bankers is that banks embarked on this journey more than a decade ago as regulatory requirements forced them to separate into dedicated business divisions with distinct customer groups such as commercial banking and private banking. Looking back, those regulatory requirements represented a huge step forward in customer centricity for banks.

Progressive banks such as HSBC U.K. and Royal Bank of Canada (RBC) have since taken steps to segment customer groups, often by age, affluence, propensity for upsell/cross-sell, etc. In 2004, for instance, RBC pored over data on its 18- to 35-year-old customers and determined that medical and dental school students and interns offered the potential to become very profitable customers.

Within the first year that RBC began addressing the financial needs of young physicians, including assistance with student loans and loans for medical equipment for new practices, RBC's market share for the subsegment soared from 2 percent to 18 percent, while revenue per client swelled to 3.7 times above the bank's average customer, according to a CIO magazine article about the strategy.

As financial services decision-makers evaluate revenue and profit targets as part of the budget-planning process, they should also include such customer-focused metrics as:

- Share of wallet

- Profit and revenue targets versus actual targets for segmented customer groups

- Cross-sell ratios

- Customer retention figures

Getting started

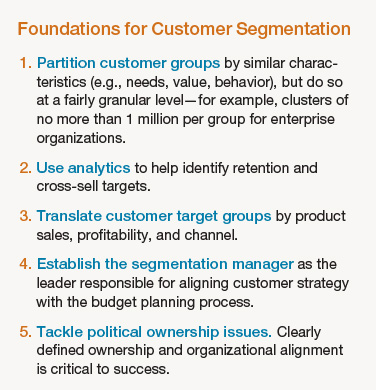

Before the next fiscal year begins decision-makers should continue their budget-planning efforts and establish targets for revenues, product margins, and the like. From there, executives can apportion anticipated revenues, profits, etc., by segmented customer groups.

As part of this process, financial services companies should align budget planning across various product groups (e.g., mutual funds, CDs, credit cards) and integrate these efforts with customer strategies. The reason for this is financial services customers often use multiple products from the same companies and information from each of the business divisions with common customers should be shared as much as regulations allow. These efforts can help segmentation managers at financial services companies to identify the likelihood for similar customers to buy certain products they don't already have in their portfolios.

Segmentation managers, who should be made responsible for overseeing these efforts, can then coordinate with product and sales managers to harmonize these campaigns since it will help bring each entity's financial targets and budget plans into sync. Meanwhile, each of the financial targets will ultimately be drawn from customer data. For instance, how many more customers do we want to acquire this year? What's the percentage of high-value private banking customers we plan to retain? What are our cross-sell goals among affluent married couples in this region?

Let's say an insurance company establishes a goal for 2011 to sell 1 million life insurance policies valued at $500,000 or higher. By analyzing targeted customer groups (e.g., high-value customers and prospects who are deemed most likely to purchase these types of policies), executives can then plot the steps needed to achieve each of the goals they set for segmented customer groups. By refining financial targets based on the buying power, characteristics, and needs of specific customer groups, executives will greatly enhance their chances for meeting those goals.

Each of the financial goals should be classified for specific customer groups that segment managers are required to track and achieve. All of the financial targets should be aligned with budget figures and be consistent with customer performance targets, such as cross-sell or upsell ratios, for each segment.

In short, budget planning shouldn't be business as usual or based on arbitrary objectives (e.g., grow revenues next year by X percent). In order to maximize the likelihood for hitting budget targets, decision-makers should plan to incorporate customer segmentation and needs analysis into their planning efforts.