Consumer banking is in the midst of a paradigm shift. Banks are looking to stand out from competitors with the types of customer experiences they deliver, not just the banking products they sell or fees they collect. The “Amazon effect” has spread to the banking world, where consumers expect companies to know them, solve their problem, and be proactive as a trusted advisor. Regulatory reform has also led banks to be more transparent and deliver a certain standard of service, while mobile and digital channels evolve to give customers new ways to interact with banks on their own terms.

At the same time, consumer banking institutions constantly grapple with the need to run efficient operations and keep costs down. Contact centers are typically an area where efficiency and cost containment trump other priorities. Already a “cost center,” increased digital and mobile investments at many banks are shifting dollars away from contact centers. But they shouldn’t be counted out as a vital customer channel. Gallup’s 2013 Retail Banking study reported that 49 percent of consumers talked to a live associate via the contact center in the past six months.

Customers prefer interacting with a live call center representative to report a problem or inquire about a fee or service charge, as well as to learn about new products and services or request a loan payoff amount, according to Gallup. These are important moments of truth that, if handled well, can build customer loyalty and advocacy. If handled poorly, a customer might be lost forever. Gallup research noted that banking customers who have a satisfactory interaction with a call center employee are 14 times more likely to be engaged with their bank.

Many consider the two concepts of customer focus and operational efficiency at odds with one another. But with the right approach, they can actually align to meet both customer and company needs. One way to align is to take a new look at staffing the customer contact center.

A flexible, home associate staffing solution can help financial services organizations achieve both cost and customer experience goals. It’s a growing trend among many financial services companies. Technology research firm Ovum predicts that financial services companies are expected to increase their share of outsourced home associate deployments through 2015. And, Frost & Sullivan reports that the financial services market is rapidly expanding its use of remote associates due to technology advances that further enhance the model by enabling experts and remote workers to provide assistance to distant locations.

4 Reasons to Embrace the Home Associate Model

There are four specific areas of opportunity where banks and other consumer finance institutions can find hidden value in using at-home associate:

- Increase efficiency and effectiveness

- Expand the talent pool

- Enable business continuity

- Internal and external morale

Increase efficiency and effectiveness

Increasing efficiency while maintaining a consistent customer experience is the goal of any company. However, the traditional banking contact center model isn’t conducive to both. It involves building physical centers staffed with groups of full-time employees (FTEs) in eight-hour shifts. They may be staggered in 30-minute increments, but that’s as flexible as they get. Most banks can track demand and predict call volume by month, week, day, and even half-hour interval. For example, tax season can be especially busy, as can lunch hours and the first and 15th day of the month when checks are issued. But too often, banks solve for the lowest common denominator, and compromise service levels to keep costs down. If known periods of failure are less costly than adding staff during those periods, then staff will not be added. It’s a poor experience for the customers who call in during those times, but the bank will weigh that risk against costs.

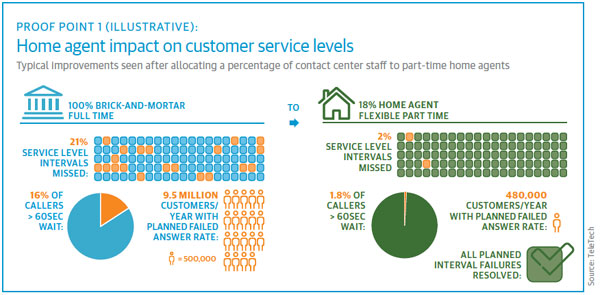

A home associate model can help improve service levels by eliminating customer experience variances, while also minimizing volume and forecast variability. It allows companies to stack part-time staff resources against specific periods of need. Instead of adding costly full-time staff or hours, resources can be reallocated to flexible part-time associates. And if done right, it can be budget neutral. What you would spend in FTEs is redirected to set up and run the at-home model. Proof Point 1 illustrates the potential impact of a bank’s decision to move a portion of its full-time contact center staff to the home associate model.

Expand the talent pool

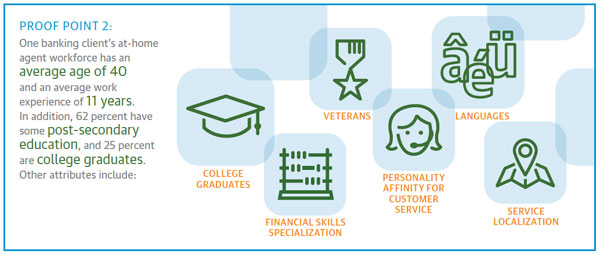

When a bank decides where to establish a contact center, considerations for the available talent pool must be mixed with real estate costs, utility prices, and other factors of running a physical operation. In addition, associates who work at a physical site must travel to work, and therefore are usually local to the area. This can limit the amount of talent or experience available. A home associate model is not bound by a recruiting radius. Financial services companies can be more selective in who they hire, since there is potential to hire from around the country. And our research shows that those who apply are three to four times more likely to be hired than physical center applicants.

Home associate talent tends to be made up of a different type of workforce. While a majority of FTE employees are young with only a high school education, part-time at-home staff are older, more experienced self-directed individuals, mixed in their socio-economic status. Unlike traditional associates, many choose to work as part-time associates to supplement income, are retirees, or work in flexible schedules that fit their lifestyles. Some have previous work experience in financial services, or in other contact centers.

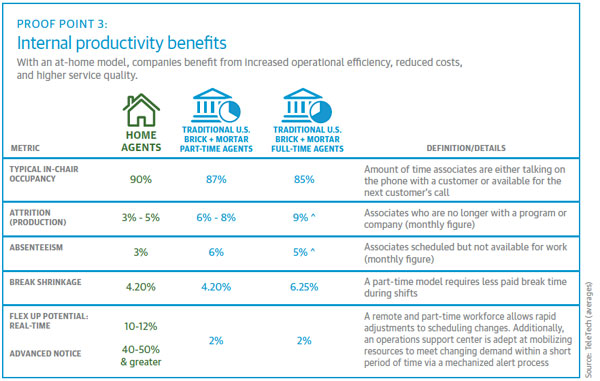

Our research found that on average these talented and experienced associates are hired more efficiently, but are also more productive and perform at a higher level. On average, they deliver higher customer satisfaction and first-call resolution, reduce average handle time, and lower attrition and absenteeism. For example, in our experience, absenteeism among the home associate population was 3 percent lower than brick-and-mortar associates (see Proof Point 3).

Enable business continuity

Redundancy is important to enable seamless business continuity if unexpected issues arise. Yet that is difficult to maintain at a brick-and-mortar site, or across multiple sites already fully utilized. Unplanned volume fluctuations happen, such as a mass compromised credit card event. Meanwhile, volatile weather is getting more volatile all the time, even in places not historically prone to it. The potential for a pandemic is real, and other unforeseen circumstances may impede operational and customer experience mandates. Regulations may require specific operating hours or availability, and some institutions must demonstrate their business continuity processes related to certain financial products and services.

The flexible home associate model allows a company to staff up capacity by as much as 50 percent in less than an hour if service volume suddenly increases. These associates are on-call in various locations, without the need for overtime pay nor lead time to commute to offices. Their electricity, Internet, and weather experiences vary, allowing them to take over if a storm or power outage occurs at the center. This virtual workforce isn’t exposed to the concentrated service outages of a facility, and can step in or scale back at a moment’s notice.

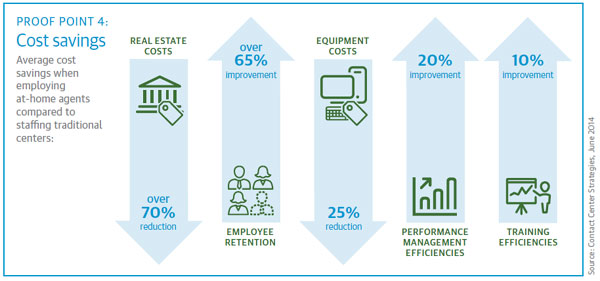

Internal and external morale

A flexible workforce benefits associate retention and morale, as well as external market reputation. Externally, a company can promote the fact that it uses U.S.-based employees. Some have even brought some offshore jobs back to the U.S. using home associates. In addition, veterans, disabled workers, retirees, and other populations can be good candidates for home associate talent, which gives jobs to groups who may have a hard time finding work elsewhere. Internally, at-home employees have higher morale and retention than physical brick-and-mortar employees, which helps keep talent acquisition and training costs down (see Proof Point 4).

Fear Factor: Security

The biggest roadblock to shifting to the home associate model is security, and with good reason. Security breaches and identity theft are real threats. Financial information is very sensitive, and can be the target of nefarious groups or individuals. The financial industry must work within regulations that require the utmost security precautions. This is a legitimate concern, and one that should be taken seriously. However, enlightened businesses look at their organization’s net risk. It’s a broad view, rather than a narrow one. While there may be increased security risks, it should be balanced with the other risks to the overall business, such as efficiency, cost containment, and customer experience.

There are many ways to mitigate risk with a home associate contact center model. First is the hiring and human capital process. Companies can tap into a larger applicant pool and be more selective with whom they hire as home associates, considering applicants based on many attributes, including trustworthiness. Contracts can include provisions about employee workspace privacy and security, as well as confidentiality. In addition, ongoing training, rewards, and incentives for security adherence can keep the issue top-of-mind for associates.

Another way to mitigate security risk is through technology controls. The tools and systems used by each associate should have the utmost security protocols, and be constantly updated to keep the systems safe from intrusion. They include anti-fraud tools, process compliance programs, data loss prevention system, and in-home video monitoring. Even with remote associates, it’s possible to keep systems and data behind firewalls and within virtual private networks. According to Ovum, virtual associate tools and technologies have improved significantly in recent years, and are more compliant with financial industry standards and legislative statutes.

Finally, there are many process controls that can be put in place to mitigate risk. Live associate observation, monitoring, and recording capabilities have become very advanced, and spot checks and regular supervisor check-ins are also recommended. In addition, the company can enact formal risk assessments and readouts to keep up with possible breaches in security.

Well behind financial executives’ security concerns are worries about a virtual associate technology implementation and the costs of moving to a virtual associate environment. It is true that there is some complexity to enabling a home associate model. We recommend working with a technology partner to ease the complexity.

Well behind financial executives’ security concerns are worries about a virtual associate technology implementation and the costs of moving to a virtual associate environment. It is true that there is some complexity to enabling a home associate model. We recommend working with a technology partner to ease the complexity.

Not all consumer financial business is conducive to the home associate model, but it is growing as a viable option. Each company must strategically look at its contact center operations to see what potential impact a home associate implementation would have on certain types of calls or lines of business. We recommend starting with pilot programs to adjust the model for optimal performance, then slowly roll it out to other areas as you learn what works best. If done correctly, your company may realize there’s no place like home.